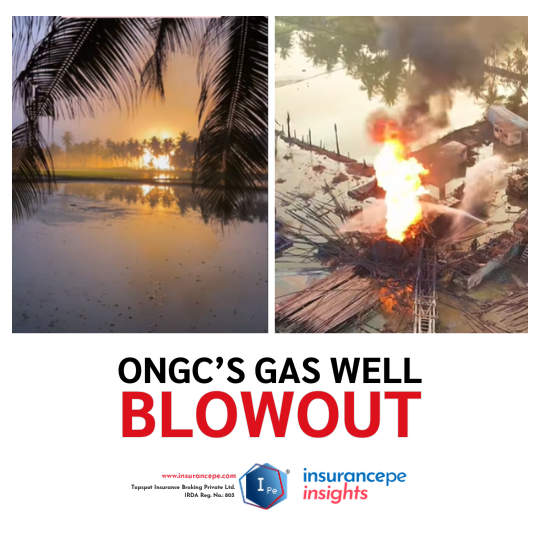

On 5th January 2026, a dramatic gas well fire broke out at Mori-5 during re-drilling operations at an ONGC-operated well in the Konaseema region of Andhra Pradesh. Flames shot more than 100 feet into the air, thick smoke spread across nearby villages, and hundreds of families were evacuated as a precaution. Although no human casualties were reported, the incident unfolded over several days and highlighted the scale of risk involved in oil and gas operations.

The fire began during workover activities intended to revive an old well. A sudden surge in underground pressure led to an uncontrolled release of gas, which ignited almost immediately.

The scale of loss

While the absence of fatalities was a relief, the financial impact of the blowout is likely to be significant. Losses in such incidents typically extend far beyond the visible fire. These include damage to drilling equipment, loss of hydrocarbons, well-control expenses, firefighting costs, environmental remediation, evacuation logistics, and potential third-party compensation.

Agricultural losses were reported in the immediate vicinity, including damage to paddy fields and coconut plantations. Aquaculture ponds and soil quality may also have been affected, requiring later assessment. In addition, shutting down operations for several days translates into substantial business interruption losses for the operator.

What insurance policies would cover an incident like this?

Large energy companies like ONGC maintain a comprehensive energy insurance programme designed specifically for high-hazard operations. In a gas well fire of this nature, multiple insurance layers are likely to respond:

What about personal insurance policies?

An important question for local residents is whether their own insurance would respond if homes or assets were damaged. If residential structures had suffered fire or blast damage, standard home insurance policies could potentially pay for repairs, provided the policy includes fire and explosion as insured perils.

However, most retail policies contain exclusions for damage caused by industrial pollution or gradual environmental contamination. Sudden and accidental damage from an external fire source is more likely to be covered than long-term exposure effects.

Crop insurance schemes, where applicable, may respond to agricultural losses, but coverage depends on enrolment, notified perils, and assessment thresholds.

In many such incidents, compensation is ultimately paid by the industrial operator under liability frameworks rather than through individual household insurance, especially when evacuation or loss of livelihood occurs without direct physical damage to insured property.

Risk transfer with “Reinsurance”

When a disaster like a gas well blowout happens, the losses can run into hundreds or even thousands of crores. No single insurance company is built to absorb that kind of shock alone. That’s where reinsurance comes in.

Insurance companies themselves buy insurance from “reinsurers” to spread very large risks across multiple global players. Instead of one insurer paying the entire bill, the loss is shared across layers of insurers and reinsurers, each taking a defined portion.

For high-risk industries like oil and gas, this is critical. A well blowout can involve:

Reinsurance allows insurers to offer very high policy limits to companies like ONGC while keeping the insurance system financially stable. Without reinsurance, many large industrial risks would simply be uninsurable, or premiums would be unaffordable.

How This Compares to Other Oil & Gas Accidents

Globally, gas well blowouts and refinery fires have resulted in losses running into hundreds of millions of dollars. In India, similar incidents (such as the offshore fire at Mumbai High North platform in 2005 which resulted in a claim of Rs. 1700 Cr being paid to ONGC) have shown that even a few days of uncontrolled flow can escalate costs rapidly due to the technical complexity of containment.

Industrial risks are not always confined to industrial zones. As energy exploration expands closer to populated and agricultural areas, the intersection between corporate insurance, public liability, and personal protection becomes sharper.

insurancepe reminds you that insurance does not prevent accidents, but when things go wrong, insurance is what bears the financial burden.

This blog post is brought to you by the minds at insurancepe!

Got questions or doubts about anyone insurance?

Need advice or help understanding your insurance needs?

Want the best bang for your buck when buying insurance?

We got you!

Reach out to us at:

Whatsapp/Phone: 89779 18030

E-mail: contact@insurancepe.com

Visit us at www.insurancepe.com